CrowdCent Curation - No. 27

—

Post Quality

CrowdCent Curation - No. 27

—

Post Quality

Hope everyone is enjoying the weekend, and welcome to all the new subscribers! Great to see the community growing - education is the focus. Feel free to check out some of the growing content & features:

“You never know what you can do until you try, and very few try unless they have to.” - C.S. Lewis

Translation: Try something new and don’t be afraid of failing - you’re more capable than you think. Most hate change, but once you have some momentum…

Finance

-

The Hindsight Depression [Article]

-

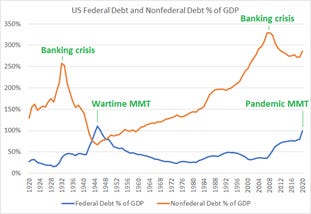

Recap: Lyn breaks down 1929-1940s vs. 2008-2020s: the similarities and differences... and the most likely path ahead.

-

Comment: Her analysis is a must-read; we share the same view on the comparison of the eras (prior 4th Turning) - expect a new Taboo in the coming month.

-

Key images:

-

-

Blockchain

-

Curve DAO Token (CRV), Uniswap (UNI), Balancer (BAL) [Post]

-

Recap: CRV, UNI, and BAL which together represent three of the larger decentralized exchanges (DEXs) and automated market makers (AMMs) on Ethereum. At the highest level, the investment thesis for this specific group of cryptoassets is that trading fees on these protocols will eventually be "passed through" to token holders...

-

Comment: Looking for DeFi assets with real cash flows? Check these ‘blue chip’ crypto-assets out.

-

CrowdCent Analyzer/GPT-3: Straight from the NLP model itself - DeFi is exploding and, like many other "new asset" markets, will experience substantial volatility. DEXs and AMMs will likely be some of the largest movers in the space. There's a clear market for DeFi protocols. Curve, Balancer, and Uniswap are all three leading protocols in that market and are fundamentally different systems with unique strengths and weaknesses. They provide the mechanism for liquidity pools to function on the blockchain, providing decentralized trustless banking and exchange. These protocols provide a large gross revenue opportunity and are trading at a highly discounted valuation

-

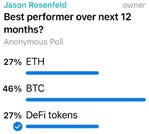

CC Community crypto-asset expectations:

-

-

Technology

-

The Big Ideas Fintech Will Tackle in 2021 [Article]

-

Recap: FinTech is eating the banking system, insurance system, and really the entire monetary system... and not a moment too soon.

-

Comment: The Fed's blunt QE tool doesn't work as ‘intended’ (just makes rich richer / inflates assets), and programs like PPP have been a disaster (fraud, slow, etc.). We need innovation, and fintech + blockchain are providing a great foundation... time to build.

-

CrowdCent Thoughts & Predictions

-

Check out the thoughts & predictions tracking update here, along with the original post (6/7/2020) - original here… these posts lay out thoughts around key market related components for 2021+

-

Site continues to expand, check out crypto-asset posts here: ETH, BTC, NMR, CRV/UNI/BAL

-

Any suggestions for CC Curation improvement, website, etc. - send an email to info@crowdcent.com

Look forward to more updates soon - the future is here...

Best,

Jason & Ryan

Website: CrowdCent

Twitter: @CrowdCent

Telegram: Link

Be the first to comment!