CrowdCent Curation - No. 41

—

Post Quality

CrowdCent Curation - No. 41

—

Post Quality

Hope you’re all having a great weekend! The content below is particularly important and education-focused — a framework for a time when things are changing fast. Any thoughts or questions? Stay connected with the community:

-

Active discussion - chat

-

CrowdCent on Twitter - link

-

CrowdCent Vision - here

-

CrowdCent ML Model - analyzer

-

CrowdCent Curation - archive

“Mindfulness + concentration leads to insight” - unknown

Translation: In a world filled with distractions, it’s hard to focus. Take the time to think deeply. Take your mind off work or news.

Finance

Dealing with the next downturn [Report]

-

Recap: This report is from 2019, but perfectly explains the swift monetary + fiscal policy response to the COVID crisis in March 2020. Prior to any thought of COVID, the Fed and government knew we were at the end of the line for monetary policy (“there is not enough monetary policy space to deal with the next downturn”) — interest rates already hit the zero bound and the mechanics of QE only inflate financial (not real world) assets, exacerbate the inequality gap (wealthy people own majority of financial assets), and exhibit diminishing returns (more you print, the less productive each incremental dollar is). To preserve the current system and their positions, those in power had to “go direct” (i.e. circumvent the banking system) via fiscal stimulus -- hence the consistent flow of $1,200 checks directly to people. Net net, combine “free money” (i.e. demand for stuff) with supply chain bottlenecks (i.e. supply issues) + easy comparisons (base effects) and we have some inflation today. Higher corporate/personal taxes are just the beginning of changes to come. The question is what is next? Full presentation here.

-

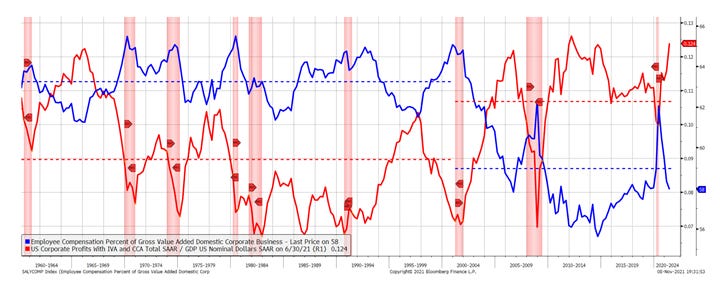

Comment: We’ve discussed this dynamic a lot in previous posts, and we think this paper + the 4th Turning framework provide a useful roadmap for how this is all likely to play out. Today we are experiencing a classic 4th Turning -- populism rises when capital / corporations share of GDP rises to extremes and labor’s falls (see chart below; h/t Darius); we are set for a massive structural system change over the next decade (we think web3 plays a big role). If you don’t want to read the (dense) 4th Turning book, check out these recent interviews with Neil where he delves into where we are today and how things are likely to unfold based on history. Raoul also does a nice job of summarizing the backdrop and how demographics come into play in his tweet thread here.

Blockchain

A Primer to Web3 [Slide Deck]

-

Recap: This short slide deck provides a great overview of web3 — the history, what it is, how it works, use cases, etc. “Web 3 refers to an internet built upon decentralized networks, such as Bitcoin and Ethereum. The key innovation of these networks is the creation of platforms that no single entity controls, yet everyone can still trust.” Alternative link (click “learn more”).

-

Comment: Tying into the above world backdrop (4th Turning, etc.), we think blockchain technology is the key enabling technology for the next system that is being built to replace the legacy system we have today. We talk a lot about web3 because we think it will be incredibly important over the next decade+ — we highly recommend learning more about it. In addition to the slide deck, a few great starter-pack resources: Chris Dixon + Naval podcast (it’s long, but worth a listen) + Chris Dixon tweet thread (Chris is a leader in the space; must-read thread filled with further resources). Remember: things can simultaneously be overvalued in the short run and revolutionary. With real interest rates deeply negative (i.e. 30-year at 2%, inflation at 6%, real rates negative 4%) it’s no surprise dog coins are going up. That won’t last, but the technology and real projects will — just like the Internet didn’t go away after the dotcom bust; frauds like pets.com went to zero, but real companies like Amazon are now worth over a trillion dollars. Now is the time to build.

Technology

The Death and Birth of Technological Revolutions [Post]

-

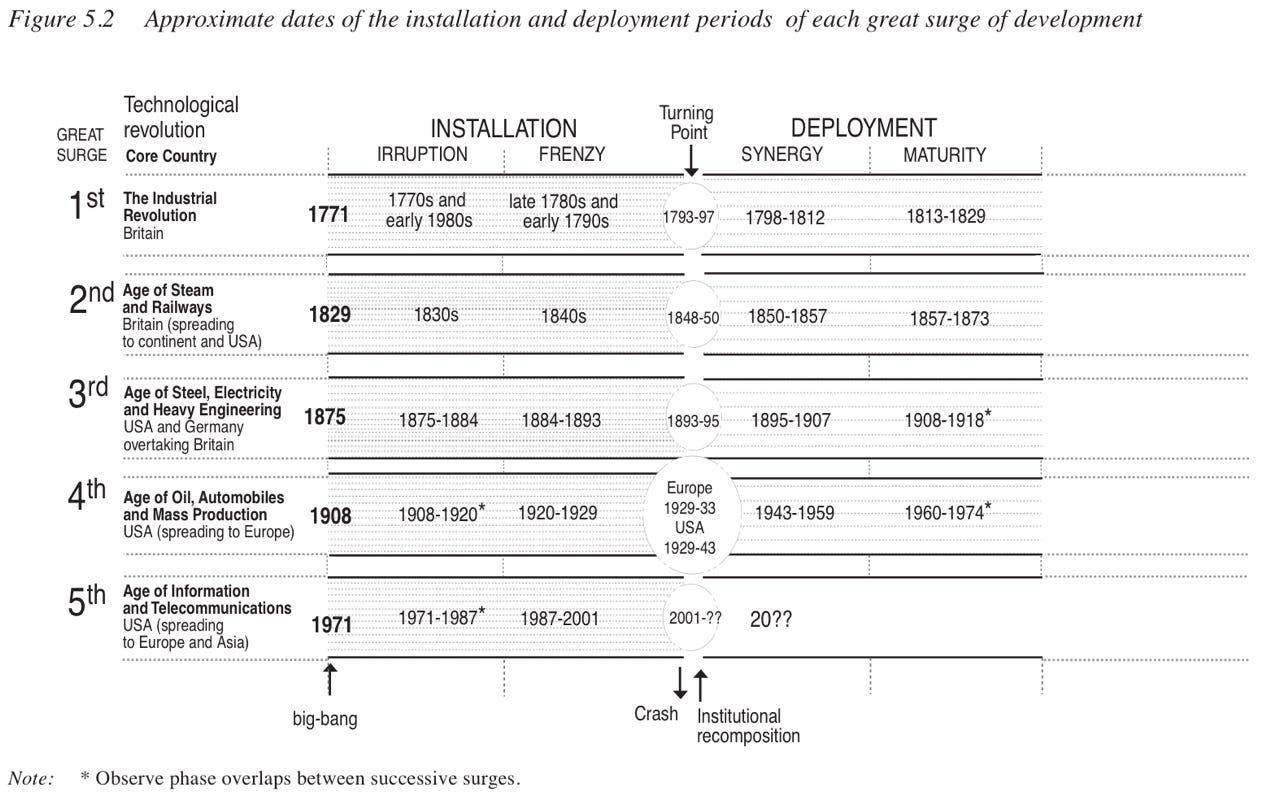

Recap: Ben recaps the history of technological revolutions and financial capital — from the industrial revolution, to the age of oil, to the information age. All of these interconnected cycles take similar shapes in terms of adoption, maturity, etc. Understanding the financial backdrop (top post above), and combining the social framework (4th turning) with the technological framework (Perez’s structure; synergy point in the information age) should lead to useful insights and a better overall template for the path forward.

-

Comment: This post nicely ties into the two above: the current system is broken, we have the enabling technologies for the next system, now it’s time to build. We’ve recommended several books in these posts in the past — few are more important than Neil Howe’s 4th Turning (noted above) and Carlota Perez’s Technological Revolutions. Both are dense — these posts + the cliff notes likely suffice. Today we are at an inflection point with many key technological evolutions that are hitting the kink in their respective s-Curves — Electric Vehicles, Machine Learning/AI, Biotech, 3D printing, Blockchain, etc. Metcalfe’s law highlights how these ‘networks’ grow exponentially. It may not feel like it, but we are at the beginning of a golden age with many of these new technologies... we need to shape how this new world is built + how this tech is implemented.

CrowdCent Products

CrowdCent is building out several new products, many of which you can test out today (email us: info@crowdcent.com):

-

CrowdCent ‘dapp’ on Numerai - check out the post here, and commentary in a previous Curation

-

CrowdCent + SumZero Baskets & Dashboard - check out a video of Jason explaining how CrowdCent is training ML algos with SZ ideas to build investment portfolios here. For a more detailed read, check out the whitepaper here.

-

Email us at info@crowdcent.com or crowdcent@sumzero.com for early access.

-

-

CrowdCent Analyzer - Want to get feedback on an investment idea? See what a trained machine learning model thinks of your idea (the probability of under/outperformance)? Email us (info@crowdcent.com) and/or check out the free private beta here.

-

You simply submit the idea (no public posting necessary), and receive a full model-generated analysis!

-

CrowdCent Thoughts & Predictions

-

In keeping with the 6-month updates, see here for our most recent tracking update (6/20/2021) from CC’s predictions on 6/7/2020 - original here (6/7/2020), 6mo update here (1/3/2021).

-

For more frequent updates and the most up-to-date thoughts, be sure to create a free CrowdCent account and join the Telegram!

CrowdCent Site Updates

-

Site continues to expand, check out crypto-asset posts here: ETH, BTC, NMR, CRV/UNI/BAL

-

Any suggestions for CC Curation improvement, website, etc. - send an email to info@crowdcent.com

Look forward to more updates soon - the future is here...

Best,

Jason & Ryan

Website: CrowdCent

Twitter: @CrowdCent

Telegram: Link

Be the first to comment!