CrowdCent Curation - No. 28

—

Post Quality

CrowdCent Curation - No. 28

—

Post Quality

Hope you’re enjoying the long weekend! Check out some of the growing community content & features:

-

Join our active discussion / chat - telegram

-

Follow CrowdCent on Twitter - @CrowdCent

-

CrowdCent Vision - here

-

CrowdCent ML Model - analyzer

-

CrowdCent Curation - archive

“Creativity is Intelligence Having Fun.” - Albert Einstein

Translation: Check out the first article (“jootsing”) below - this quote fits nicely into the theme and helps describe what “creativity” really is and how it comes about.

Finance

-

“Jootsing”: The Key to Creativity [Article]

-

Recap: Creativity breakdown: 1.) Gain a deep understanding of a particular system and its rules. 2.) Step outside of that system and look for something surprising that subverts its rules. 3.) Use what you find as the basis for making something new and creative.

-

Comment: While this post doesn't directly apply just to Finance, we thought it was particularly relevant to how many former bankers, traders, consultants, etc. are now moving to disrupt the industries they were once entrenched in. Blockchain and broader FinTech are enabling technologies to help accelerate the improvement of these legacy systems and structures (from banks to hedge funds, and so on). CrowdCent is one of the many examples of companies (along with Hedgeye, Numerai, daloopa, Real Vision, among many others) looking to leverage tech to reshape these industries and improve society...

-

Blockchain

-

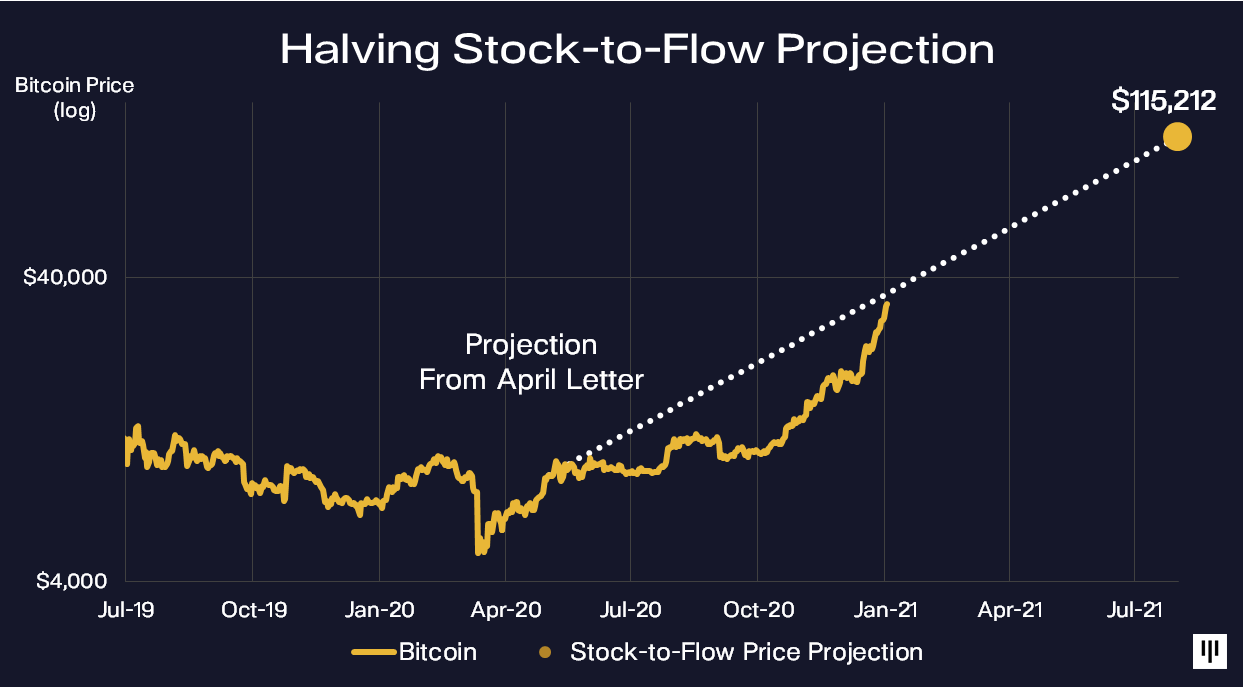

Bitcoin Rally (2017 vs. Today) [Article]

-

Recap: Article delves into the dynamics around bitcoin halvings (supply side), and the (diminishing, though still substantial, returns) impact on price.

-

Comment: Pantera Capital is one of the clear thought leaders in the crypto-asset space, with investments from BTC/ETH, to many of the "lesser known" (but equally exciting) DeFi projects. This article is worth a read simply to put Bitcoin supply/demand (and thus price) into context..

-

Images:

-

Technology

-

Fintech’s Final Frontier: Central Banks and Disintermediation [Article]

-

Recap: The Internet disintermediated many middle men - from travel agents, to mail order catalogs - and in the process made things much more efficient. But the banking system has been largely unchanged / "unscathed"... until now. FinTech will change everything - allowing governments to directly interact with citizens, and circumvent the legacy banking system that hasn't changed in centuries.

-

Comment: Rampell is likely the best FinTech investor of our generation - both his articles (like this one) and his investments are worth actively monitoring. As we've noted many times before, the Fed's current "blunt tools" don't work - most of the capital gets "stuck" in the banking system, and the outcome ends up being purely financial asset inflation (enriching the already rich). Expect this tool set to change in the coming years...

-

CrowdCent Thoughts & Predictions

-

Check out the thoughts & predictions tracking update here, along with the original post (6/7/2020) - original here… these posts lay out thoughts around key market related components for 2021+

-

Site continues to expand, check out crypto-asset posts here: ETH, BTC, NMR, CRV/UNI/BAL

-

Any suggestions for CC Curation improvement, website, etc. - send an email to info@crowdcent.com

Expect the building to continue - the future is here...

Best,

Jason & Ryan

Website: CrowdCent

Twitter: @CrowdCent

Telegram: Link

Be the first to comment!