CrowdCent's Vision

4.8

Post Quality

CrowdCent's Vision

4.8

Post Quality

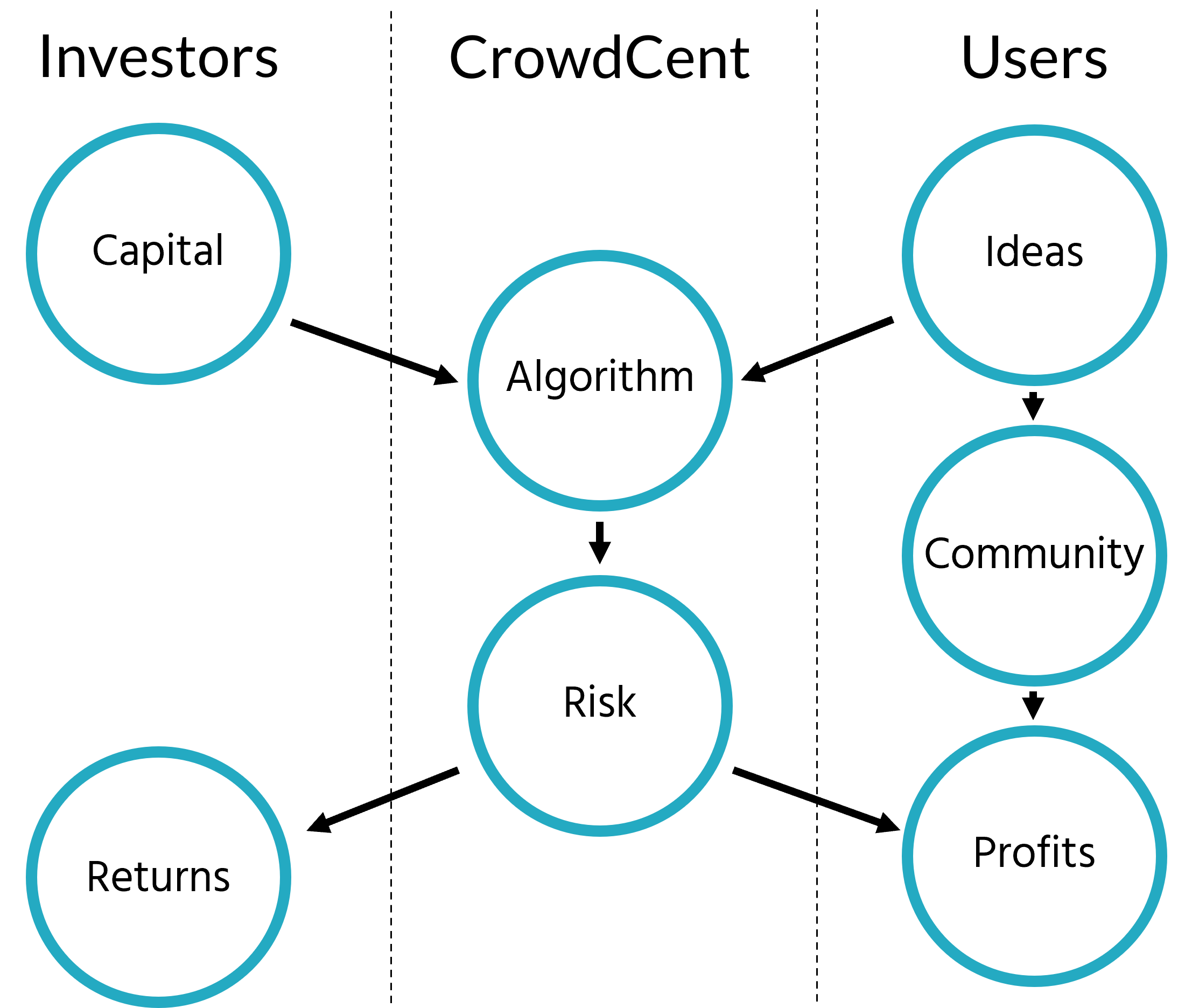

The strategies and organizational design of the discretionary hedge fund are under attack. A large portion of the industry continues to rely on broken, pre-internet strategies that are too slow. CrowdCent envisions a new type of fund: decentralized and democratized, employing natural language processing, machine learning, and—most importantly—a community’s expertise to outperform the market with a long-term, bottom-up, fundamental-based value investing strategy.

CrowdCent is an experiment. Can we internally simulate a market comprised of experts, eliminate emotional biases and consistently outperform the market? Is the whole of a group of decentralized investors greater than the sum of its parts? We think so. Artificial intelligence will not be usurping a bottom-up, fundamental-based value investing strategy anytime soon. Rather, machine learning and decentralization will improve the process of fundamental value investing.

Crowdsourced Investment Process

Three important themes have grown and converged to make this all possible:

Three important themes have grown and converged to make this all possible:

1) Decentralization

Decentralization is a powerful force—enabled by new technologies—sweeping through industries, flipping business models on their heads, and removing inefficiencies from the marketplace. Airbnb, Uber, and Etsy are all easy examples of players who have leveraged decentralization to disrupt their respective industries.

The idea of “decentralized/crowdsourced hedge funds” in various forms is gaining more credibility as companies like Quantopian and Numerai experiment with new business models. Quantopian has created a back-testing and live-trading platform for algorithmic traders—top algorithms are identified, allocated capital and the algorithms’ creators are granted a portion of the profits. Numerai exports its own financial data to a group of data scientists in order to create a “meta-model” on which Numerai can deploy fund capital. In both cases, users are entitled to compensation based on their contributions to some function of fund performance.

CrowdCent differs in that the vast majority of our data–investment write-ups from professional investors–are sourced from a curated user base in order to make stock predictions. CrowdCent’s systematic layer and algorithms do the heavy-lifting on top. The idea of an online community for professional investors is also not new. SumZero and Value Investors Club offer two examples of how to facilitate the virtual trade and rating of investment ideas. SumZero is an exclusive community for verified buy-side investors. The platform provides its users with research ideas from members of the hedge fund, mutual fund, and private equity analyst community. Ideas include price targets, expected timeframes, valuation discussion, and catalyst review. Value Investors Club does not limit its user base to professional investors, but a limited number of members qualify for acceptance. Membership is free and users must post a minimum of 2 of their best investment ideas per year.

CrowdCent adds one twist here, too. We want to ultimately return excess profits to users for their ideas and use various natural language processing models paired with traditional market data to pick the ideas most likely to outperform the market out of the wide swath of investment opportunities presented to and by the community. Simply, decentralization allows for the aggregation of investment write-ups to create a database to which a typical quant fund does not have access.

2) Democratization

Responsible decentralization mandates democratization. Namely, nobody is in charge yet everyone is. At CrowdCent, each investment idea stands on its own merit such that the wisdom of the crowd can be evaluated on a level playing field. Open debate and discussion must be encouraged and analyzed. We want to create a community where incentives are balanced and great investment ideas can be shared with a group of like-minded investors with backgrounds from any discipline. Although we will carefully curate our user base, users do not need to be professional investors—they only need to demonstrate investment ability and prowess. Once admitted, users will have a database of best-ideas and discourse with top investors at their fingertips (while earning a portion of the fund’s profits without putting in any additional work).

We believe that this community can synthesize new ideas and source data not yet widely disseminated to the market. Great investors realize that “the world is filled with ‘soft data,’ relevant sights, sounds, smells, tastes, and textures that are yet to be digitized — and hence are unavailable to those working at their computers.” Great investors visit company plants and headquarters; great investors can qualitatively gauge the abilities of a management team.

When we allow for each of these investors’ voices to be heard, we believe the result is an internally simulated, “smarter” market that can gauge fair value among experts only. With all of this information, we are only one step away from deploying a proprietary machine learning algorithm to eliminate emotional and behavioral biases.

3) Systematic decision making

Separating emotion and reason is integral to a successful fundamental-based value investing strategy. As we know from the work of Kahneman and Tversky, “to maximize predictive accuracy, final decisions should be left to formulas, especially in low-validity environments.” Moreover, “do not simply trust intuitive judgment—your own or that of others—but do not dismiss it, either.” At CrowdCent, these findings (and much of Kahneman and Tversky’s research) are hardwired into the structure of how we operate. An investment idea’s probability of outperformance will initially be assessed based on the language incorporated into the write-up, the user’s track-record, the security’s fundamentals, and other financial data.

Our early models trained on a pre-existing community of investors indicate that we can achieve potential outperformance compared to both the market and the average of the community. However, in the face of new facts, positions need to be re-evaluated. Constant calibration comes in the form of community feedback and discussion. Each time a user comments or rates an investment idea, the algorithm can incorprate feedback into the decision making process, re-evaluating the probability of success for a given investment idea. The result is a living, breathing rebalancing act responding to the community’s credibility and CrowdCent’s machine learning models.

Tying it all together

The combination of these themes enables a radically different way of sourcing data, analyzing opinions, and compensating a user base. At CrowdCent, we can use them all together to gather expert advice, learn from the wisdom of crowd, and create an ensemble of quantitative value-investing models with an aim to deliver outsized investment returns over the long-term.

Be the first to comment!