CrowdCent Curation - No. 42

—

Post Quality

CrowdCent Curation - No. 42

—

Post Quality

Hope everyone is enjoying the weekend! Check out the great content below, as well as some updates to our predictions over the coming years. In addition to our recent resources post, we think this package is a must-read in preparing for the next (tumultuous) decade. In addition, welcome Carlo to the CrowdCent team! He has already added some awesome new features — like GPT3 summaries — below.

-

Active discussion - chat

-

CrowdCent on Twitter - link

-

CrowdCent Vision - here

-

CrowdCent ML Model - analyzer

-

CrowdCent Curation - archive

“If you worked as hard at doing difficult things as you did avoiding them, you’d become unstoppable.” - Shane Parrish

Translation: You can have excuses or results. Not both.

Finance

Big Cycles Over the Last 500 Years [Post]

-

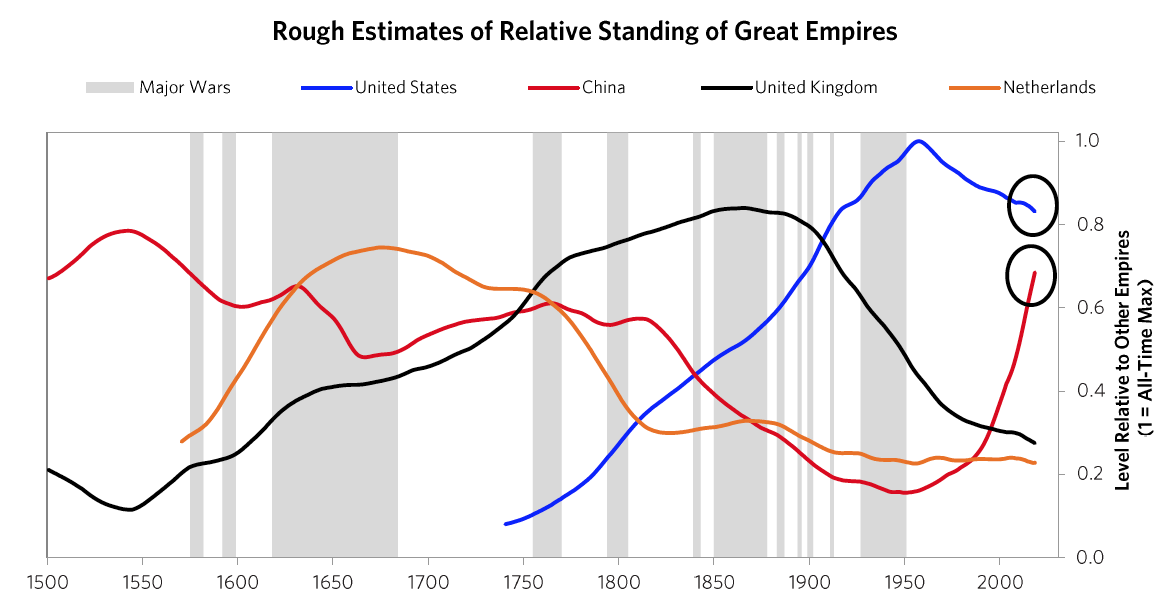

Recap: Dalio delves into the history of empires and global reserve currencies – from the Dutch to the British to the US – and puts into context where we are today.

-

Comment: Very helpful piece that walks through the rise and fall of empires – systematically analyzing key components across each to gauge relative strength. The net of it: we are at a key juncture in history where the US (and USD hegemony) is being challenged. All ties into our predictions (bottom of post). This piece by MacroAlf and this post by Lyn Alden tie Dalio’s bigger picture system view back to today’s setup for the stock market and investing environment – GPT3 (natural language processing tech) provides a quick summary of both articles below.

-

GPT3 (Alf): This obsession about short-term market performance puts investors at great risk of missing the forest for the trees. This article will zoom out and focus on the forest. Cheap credit is cheap money from the future. In 1971, the Gold Standard effectively came to an end. President Nixon ended the convertibility of USD into gold at a fixed price, and effectively introduced the fully elastic fiat system we have been living with since then. That’s how it works: commercial banks and governments can now create credit out of thin air and add net worth to the private sector without having to worry about the intrinsic value of the newly created money - the peg to gold is gone. The main drivers of long-term economic growth peaked in the 80s, and politicians find it unpalatable to have the economy grow at a slower pace. Especially when they are sitting on a monetary system that allows fully elastic credit creation: so, lets leverage it up guys! The main drivers of economic growth in the long run are working-age population growth and productivity growth: both peaked in the 80s.

-

GPT3 (Alden): Lower interest rates allow companies to borrow money at a lower cost and invest that capital into growing the business. Corporate tax cuts are important for the US equity market, because corporations use their extra cash to buy back. The petrodollar is the reason why other countries still want dollars. The US created a system that gave us the benefits of an oil discovery without actually finding any oil. The US has been using other countries' dollars to buy its own assets via current account deficits and the US is selling its assets to foreigners, and the rest of the world owns a growing percentage of US assets. Passive investment inflows into large, expensive stocks are responsible for nearly all of the past decade. Stocks have a forward return that is higher than the marginal cost of capital. I think the US stock market has been an incredible investment for a long time, but I am now concerned. The US dollar may be on the verge of a significant decline.

Blockchain

Zero Knowledge [Post]

-

Recap: Zero Knowledge Proofs (ZKP) are an incredibly important technological development around security that will dramatically change industries, privacy, etc. Simplistically, ZKPs ‘let someone prove that they know or have something without giving up any information about what they know or have’ (e.g. proving you know a password without actually entering it into some website [where there is risk of exposure]).

-

Comment: While this is a complicated topic (the math behind it is quite complex), it is something worth getting up-to-speed on the basics of and thinking about applications. Blockchain + ZKPs = a powerful combination. For example, think about the apartment application process – where you send unencrypted (unsecure) SSN, income, etc. data to a real estate agent over email – the eventual scaling of ZKPs will help create systems that make this a thing of the past..

-

GPT3: An enormous amount of value (both fundamental and speculative) will be created around anything that touches zero-knowledge proofs. What’s ultimately so promising about ZKPs is that they have the potential to eliminate a major trade-off inherent in living, working, and transacting online: the convenience, speed, reach, and scale of the internet in exchange for our privacy. In Zcash, zero-knowledge proofs specifically enable the network of computers running the Zcash protocol to verify that every transaction is valid (i.e. I actually have the 10 Zcash I am sending to you) while maintaining the privacy of the transaction data. Zcash and other privacy-oriented cryptocurrencies have attracted a great deal of attention -- and money.

Technology

Three Steps to the Future [Slide Deck]

-

Recap: Ben Evans annual slide deck focused on the upcoming most transformative tech of the next decade – from crypto/web3, to AR/VR, to the metaverse.

-

Comment: Always worthwhile to flip through this slide deck – we agree with many of the focus areas, particularly web3 (blockchain = enabling tech) and metaverse (AR/VR = enabling tech). In addition, some highly recommended annual and/or thought pieces around next gen tech: The AI Revolution (we think AI/ML is going to be incredibly transformative), The Metaverse (interesting interview with Zuckerberg), Stratechery Year in Review (2021 review of current/emerging tech).

CrowdCent Products

CrowdCent is building out several new products, many of which you can test out today (email us: info@crowdcent.com):

-

CrowdCent ‘dapp’ on Numerai - check out the post here, and commentary in the previous Curation

-

CrowdCent + SumZero Baskets & Dashboard - check out a video of Jason explaining how CrowdCent is training ML algos with SZ ideas to build investment portfolios here. For a more detailed read, check out the whitepaper here.

-

Email us at info@crowdcent.com or crowdcent@sumzero.com for early access.

-

-

CrowdCent Analyzer - Want to get feedback on an investment idea? See what a trained machine learning model thinks of your idea (the probability of under/outperformance)? Email us (info@crowdcent.com) and/or check out the free private beta here.

-

You simply submit the idea (no public posting necessary), and receive a full model-generated analysis!

-

CrowdCent Thoughts & Predictions

-

Check out below for some thoughts on the next decade – we will be adding to this (trackers, etc.) in the weeks ahead. These thoughts build upon our previous predictions, which you can find here (6/20/2021) – original here (6/7/2020), 6mo update here (1/3/2021).

-

There is an overriding theme to the prior predictions and thoughts below – we are entering an inflationary decade, nearing the end of the current monetary system / USD hegemony, and expect the rise of a new system (energy, money, etc.)

-

-

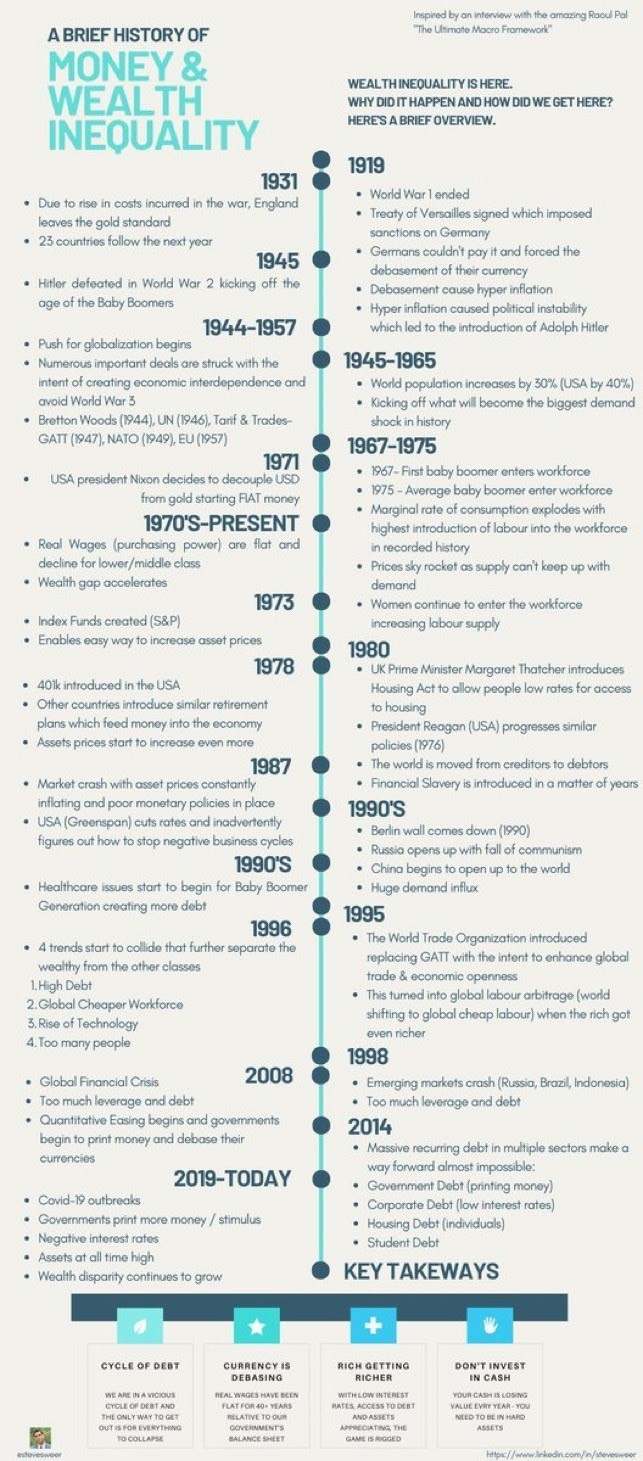

The USD-centric monetary system (history in graphic below) is likely to change in the next ~5 years (likely to a digitally backed basket). Must watch video –summarizing how we got here.

-

This coincides with our lower USD expectation – the release valve to the heavily indebted/manipulated system. As part of this transition, USD hegemony is at risk. We are already seeing challenges to the system today with Russia (low debt; owns a lot of gold as well as commodities) potentially set to annex Ukraine, followed by China looking at Taiwan. It’s possible that this current Cold War 2.0 will turn into something larger in the next few years.

-

-

Expect to see a shift in power from capital towards labor. DAOs likely end up being a key enabling tech for labor.

-

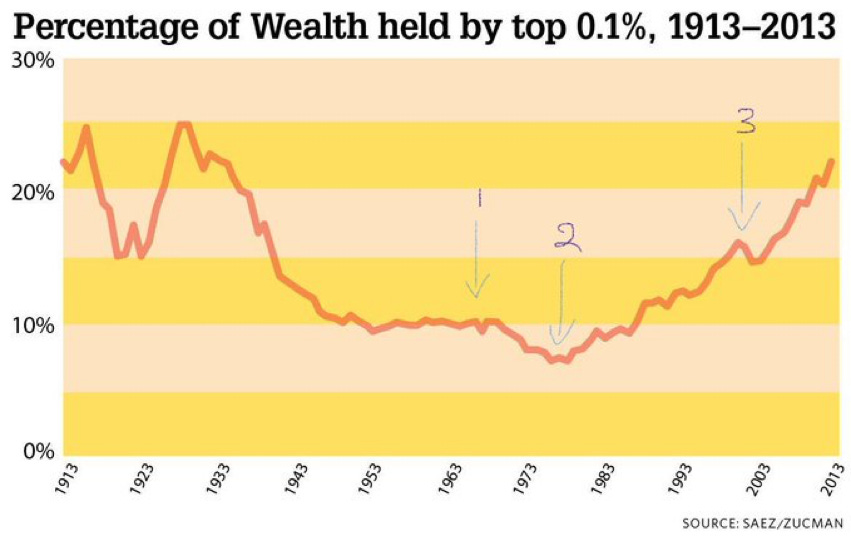

The current system (mostly since going off the gold standard in 1971) has created massive wealth inequality, as well as a related shift in power from labor to capital. We expect both to reverse in the decade ahead – rising power to labor and a redistribution of wealth. Individual and corporate tax rates are going higher. Fiscal stimulus will focus on the low-end, as well as infrastructure (particularly electrification).

-

-

While we expect near term inflation is peaking out in rate-of-change terms (7% y/y will move to 5% by mid year and closer to 3% by year end), we believe we are entering an inflationary decade – likely driven by a further fiscal response to the next slowdown.

-

In our original predictions, we called out the return of real world inflation. That has clearly played out over the last 18 months.

-

In an inflationary environment, you will want to own real assets (e.g. farmland, housing, commodities) – which is what China has been buying (borrowing USD, buying real assets, increasing it’s sphere of influence) over the past several decades.

-

-

Crypto will be the best performing asset class over the next decade.

-

While we likely have further to go in the current correction (which we noted in our last predictions update), we continue to believe blockchain technology is helping to build the next gen financial system. And key tokens (BTC as digital gold, ETH as layer 1/compute, among other projects) will accrue significant value in the process. There are also certainly many frauds within the ecosystem; token selection will be key, but the overall space will grow dramatically.

-

In addition, demographics help drive asset allocation over time - expect to see millennials (and younger) embrace crypto as they enter primary earning years.

-

-

The next decade will see a significant bull market in emerging markets, particularly SE Asia (India, Indonesia, Vietnam, etc.). Driven by weaker USD, positive demographics, positive commodity exposure, and supply chain localization

-

This will also coincide with the general de-globalization theme. And the movement from just-in-time supply chains to more resilient chains with buffer inventories.

-

-

The rise in populism has been brewing for years, partially due to the structure of the financial system (see labor/capital and wealth inequality above) – expect this leads to an acceleration in the change of authority. We are already seeing this with the turnover of Federal Reserve officials.. Expect to see more of this in Congress.

-

Neil Howe’s 4th Turning prediction is amazingly accurate thus far, and we think there is more to go.

-

-

Further tied into all of the above, we will transition away from the current fossil fuel / oil driven system on the margin (and petrodollar financial system) toward a next gen alternative energy ecosystem (e.g electrification).

-

The current alternative energy system infrastructure is not ready. And we cannot just shut off the carbon economy – which is part of the reason why we are seeing the spike in oil today (limited supply, but demand remains). Over the next decade, expect significant investment in next-gen alt energy infrastructure driven by fiscal incentives/packages. Rare earth minerals, battery materials and semiconductors will be incredibly important.

-

CrowdCent Site Updates

-

Site continues to expand, check out crypto-asset posts here: ETH, BTC, NMR, CRV/UNI/BAL

-

Any suggestions for CC Curation improvement, website, etc. - send an email to info@crowdcent.com

Look forward to more updates soon - the future is here...

Best,

Jason & Ryan

Website: CrowdCent

Twitter: @CrowdCent

Telegram: Link

Be the first to comment!